Virginia Energy , with the assistance of Fugro Consultants LLC, has completed an analysis of Virginia's readiness for offshore oil and gas exploration and production. The study focused on three topics as directed in the Commonwealth's 2014-2016 biennial budget, which authorized the study. The topics are listed below along with key findings and recommendations.

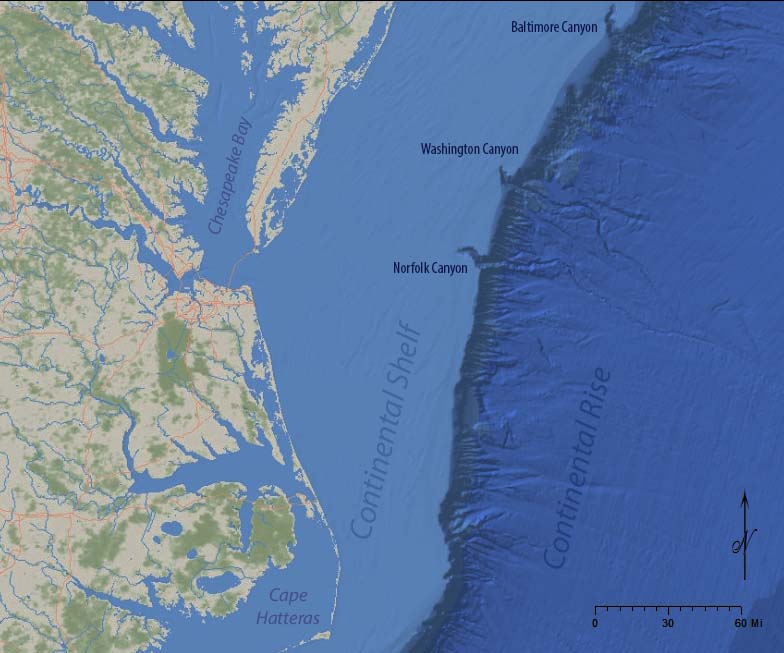

1. The adequacy of current geological and geophysical information regarding oil and gas resources in the Mid-Atlantic. This part of the study examines existing data off of the coast of Virginia and northern North Carolina. Even though no oil and gas exploratory wells have ever been drilled in the area, over 46,000 line-miles of legacy seismic data are available. Although acquisition parameters typical for data acquired in the 1970s and 1980s limit both the vertical resolution and depth penetration compared to modern seismic acquisition, data coverage is good for the outer shelf and shelf edge. In deeper water beyond the shelf edge, data coverage is relatively sparse. Acquisition of new data, as proposed in geophysical permit applications pending approval by the Bureau of Ocean Energy Management (BOEM), would greatly improve the ability to image exploration targets. A hypothetical seismic survey proposed in the study could be acquired, processed, and interpreted in less than a year.

2. A detailed overview of the infrastructure needed to support oil and gas exploration and development. The offshore oil and gas industry requires a range of services, including materials supply and storage, transportation, communication, platform and rig construction, oil and gas receiving and distribution, vessel service and repair, waste disposal, and oil spill response. The study compares the facilities needed to support the mature oil and gas industry on the U.S. Gulf Coast to facilities available in the mid-Atlantic. The study concludes that the mid-Atlantic region has sufficient marine terminal and shipyard facilities to support oil and gas leasing, exploration, development, and production. A variety of oil spill response agencies, organizations, and private companies could provide service to the mid-Atlantic region. The major infrastructure shortfall is in oil and gas receiving, processing, and distribution. This capacity could be developed once commercial reserves are proven.

3. A plan to address any concerns that may be raised by the military. Coastal Virginia contains the largest concentration of military ships and aircraft in the world. The U.S. Department of Defense (DoD) makes extensive use of Virginia's offshore waters to conduct mission-critical training and testing. Other uses of those waters, such as oil and gas drilling and production, have the potential to conflict with the military's mission. The DoD supports the production of offshore energy and is a willing stakeholder in supporting a workable resolution to conflicting uses, whenever possible. The study provides several examples of offshore areas where cooperation and coordination has resulted in energy production co-existing with military training and testing. The Commonwealth should initiate early coordination with DoD, including the formation of an intergovernmental task force representing the numerous stakeholders with an interest in offshore waters. Strategies to resolve conflicts could include memoranda of agreement, lease stipulations such as drilling windows, and commitment to advanced technologies to minimize the footprint of oil and gas operations.

The full 270-page study can be viewed or downloaded here.

Frequently Asked Questions:

Why did Virginia Energy conduct this study?

How were the topics of the study selected?

How was the contractor selected?

What is Virginia's policy on offshore oil and gas?

How much oil and gas is present off of Virginia's coast?

How many jobs will be created if offshore drilling comes to Virginia?